Why The 1% Should Pay Tax At 80%

The Article: Why the 1% should pay tax at 80% by Emmanuel Saez and Thomas Pinketty in The Guardian.

The Text: In the United States, the share of total pre-tax income accruing to the top 1% has more than doubled, from less than 10% in the 1970s to over 20% today (pdf). A similar pattern is true of other English-speaking countries. Contrary to the widely-held view, however, globalisation and new technologies are not to blame. Other OECD countries, such as those in continental Europe, or Japan have seen far less concentration of income among the mega rich.

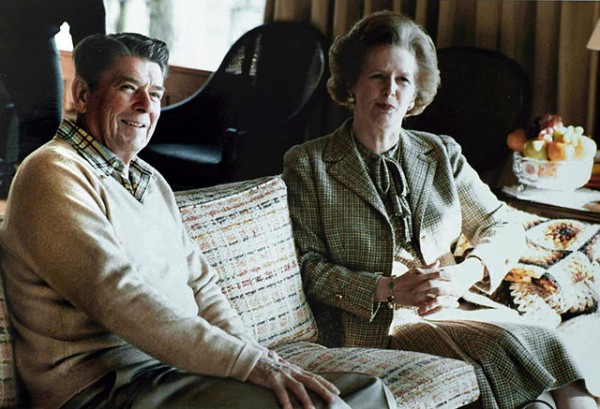

At the same time, top income tax rates on upper income earners have declined significantly since the 1970s in many OECD countries – again, particularly in English-speaking ones. For example, top marginal income tax rates in the United States or the United Kingdom were above 70% in the 1970s, before the Reagan and Thatcher revolutions drastically cut them by 40 percentage points within a decade.

At a time when most OECD countries face large deficits and debt burdens, a crucial public policy question is whether governments should tax high earners more. The potential tax revenue at stake is now very large.